Tryperion

Tryperion Holdings is a private equity real estate company with over $1 billion in assets, and over 30 deals created since 2013.

Client Overview

Tryperion Holdings rebranded from Tryperion Partners, which I spearheaded the branding changes. My role was to expand brand awareness, create fundraising strategies for acquiring HNW investors, create/expand the firm’s presence as a syndication for real estate investment offerings, and generate media and collaborative branding material for the firm, such as branded pitchbooks and the website. Marketing efforts led to raising $7.8M from syndicated offerings in 2022-2023 and creating investor materials that secured $46.5M in Fund IV in 2024 from HNW investors.

Company

Tryperion Holdings

Title

Marketing Director

Industry

Real Estate Investing / Private Equity

Duration

April 2018 - Present

- The Challenge

Tryperion Holdings is the private equity entity that manages the Streitwise assets. Tryperion Holdings rebranded from Tryperion Partners, which I spearheaded the branding changes. My role was to expand brand awareness, create fundraising strategies for acquiring HNW investors, create/expand the firm’s presence as a syndication for real estate investment offerings, and generate media and collaborative branding material for the firm, such as branded pitchbooks and the website. The rebrand and newly created investor materials helped secured $46.5M in Fund IV investments in 2024 from HNW investors.

I provided investor support for both retail investors and family office / accredited investor support with Tryperion’s private equity fund offerings. This includes customer service, tech support, offering support, portfolio strategy communication, investor portal setup, phone/chat center, chatbot setup.

The brand overhaul from a private equity real estate firm to a multi-offering syndication marketplace was successful and we raised $7.8M from syndicated offerings in 2022-2023.

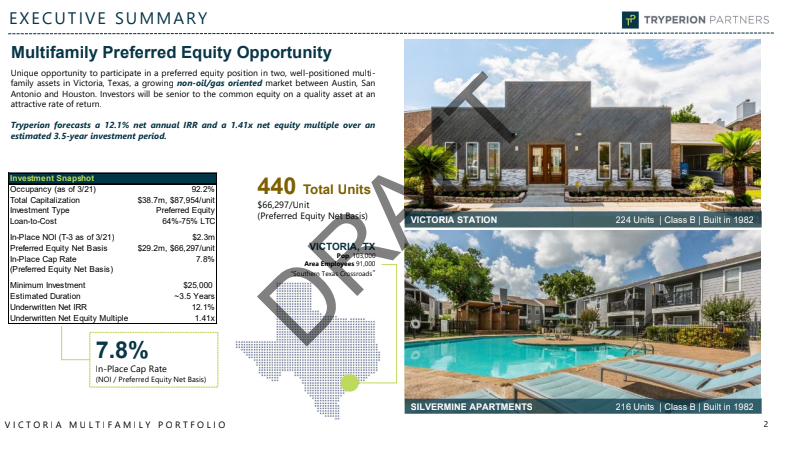

I built a syndication marketing platform for multifamily properties to investors to invest in (such as Royce at Trumbull apartments in Connecticut and Victoria Station Apartments in Victoria, TX) in order to diversify from the Streitwise Office REIT and increase fundraising activity.

| Syndication Offering Investments – 2022 | $4.5m |

| Syndication Offering Investments – 2023 | $3.3m |

| Fund IV Investments | $46.5m |

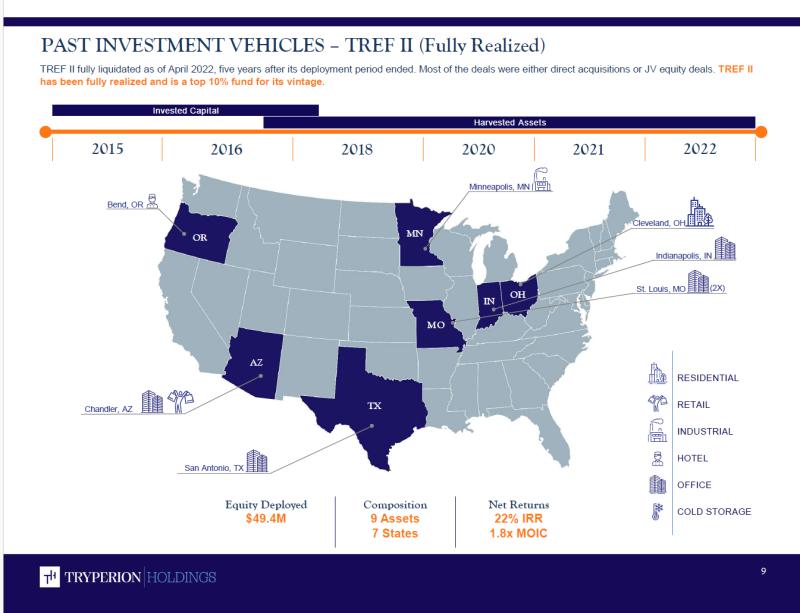

Created Tryperion pitchbooks showcasing firm’s assets and performance to pitch Tryperion RE Fund IV to high-net-worth investors.

Data is from 2024 among high net worth investors.

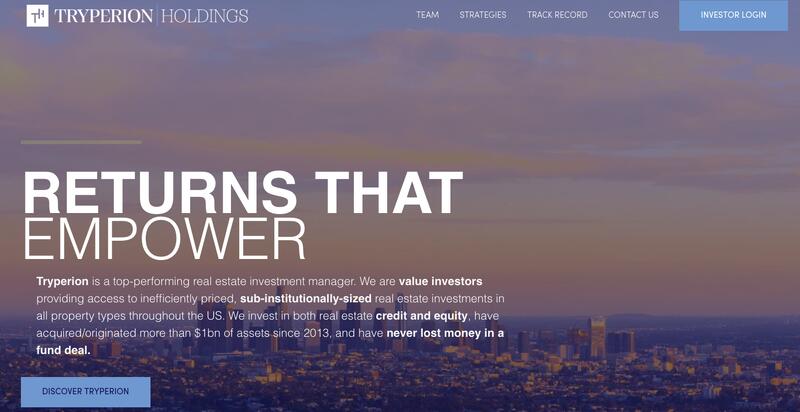

Created new Tryperion website with syndication marketplace.

| Conversion Rate | +19% |

| Organic Traffic | +52% |

| Direct Traffic | +61% |

| Branded Search Traffic | +46% |

| Earned Media | +23% |

Among the properties that Tryperion owned, I provided marketing consultation / reporting for various multifamily properties we owned. This included paid media reports, iLS reports, and web traffic reports. These metrics were used to provide further guidance for the on-site marketing departments.

- Co-Founder & CEO Testimonial

Alex spearheaded the creation of several separate syndication offerings, helping raise $7.8 million in 2022-23 among accredited retail investors, as an added revenue stream.

His work includes strategic collaboration with the executive team and Board on key decisions such as setting minimum investment thresholds and ensuring SEC

compliance in the marketing campaigns. Alex also played a crucial role in managing our

investor relations and communications during the post-Covid period when we began fielding a growing number of questions about our office-focused portfolio.

Jeffrey Karsh

Co-Founder & CEO, Streitwise

Largest Wins at Tryperion

01

Tryperion Rebrand

When Tryperion rebranded from Tryperion Partners to Tryperion Holdings due to a corporate restructure, I helped overhaul the outreach strategy with new branded pitchbooks, new branding, website, and pitch material (one pagers). And helped navigate to a new investment dashboard.

02

Syndication Marketplace

Creating a syndicated marketplace allowed us to target higher net worth retail investors and allow them to participate in our multifamily deals. This created an additional revenue stream of $7.8m from 2022-23.

03

HNW Investor Strategy

Worked with C-suite and various outreach tools such as a new AI outreach tool to find HNW leads that were put into a new sales funnel to convert from lead > pitch > commitment > investment. This lead to $46.5 million in funded commitments to Tryperion Real Estate Fund IV in 2024, alone.

Looking to grow your fintech / financial services, proptech, or real estate firm? I can help.