Streitwise

Streitwise is a Reg A+ real estate crowdfunding service specializing in commercial (office) real estate investing, open to investors of all wealth levels since 2017 with over $42 million of retail and institutional capital raised.

Client Overview

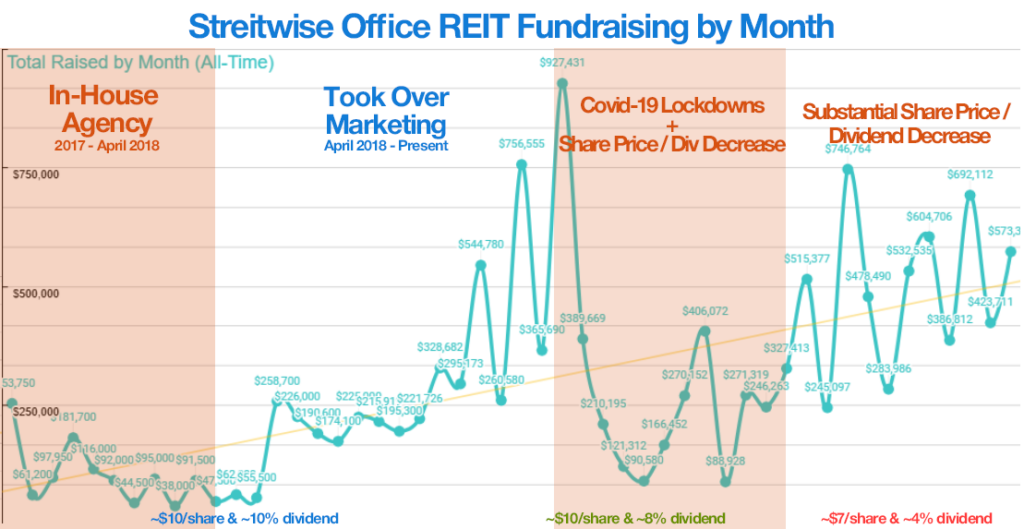

At Streitwise, I led marketing and fundraising efforts for the Office REIT, raising over $20 million from 1,500+ retail investors with five consecutive growth years (over $6 million in 2022) and raising $7.8M from separate syndicated offerings in 2022-2023.

Company

Streitwise (Tryperion Holdings)

Management Entity

Tryperion Holdings

Title

Marketing Director

Industry

Real Estate Investing / Fintech

Duration

April 2018 - Present

Team Size

4-5 associates

- Background

When I joined Streitwise, the company’s REIT was struggling. Despite managing a promising office REIT, Tryperion had only a handful of investors, mostly family friends, and their marketing agency had generated few leads and even fewer investments. With previous success taking Bitcoin IRA to market, managing the lead generation strategy for a department that would eventually bring over $90 million in investments and success growing the real estate agency GTMA to over 300 clients, I was brought in to turn things around.

I quickly overhauled Streitwise’s branding, partnering with Saatchi & Saatchi for a new logo and rebranding from “stREITwise” to “Streitwise.” I redesigned the website to focus on lead generation and enhanced the user experience to capture sign-ups and a new investor portal to help users track their investments. I worked with the C-Suite and regulatory bodies to add the ability to auto-invest and reinvest dividend earnings and enhance the sign-up process.

Once the lead funnel and customer lifecycle was generated, , I formed key partnerships with financial influencers (such as the Motley Fool), enacted a heavy paid media / SEM campaign to grow the brand.

To continue to leverage growth into the post-Covid office era, I worked with the C-Suite to expand our product offerings using Reg A+ and 506(b) / 506(c) syndications, to allow investors to invest in multifamily offerings. We raised $7.8 million in 2022-23 from this separate product alone.

By 2022, we raised over $20 million from 1,500+ retail investors, with $6 million raised that year alone, all on a minimal marketing budget. Over $5 million from managed partnerships.

Through strategic marketing, fundraising optimization, and a clear focus on investor experience, I helped transform Streitwise into one of the largest real estate crowdfunding services in the industry.

Spearheaded fundraising for Office REIT, raising over $20M from 1,500+ retail investors with five consecutive growth years, including over $6M in 2022 on a $60k annual marketing budget (12.83 ROAS profit)

| Total Investments (All Offerings) – 2018-Present | Over $28m w/ 6 consecutive growth years |

| Total Investments (Office REIT) – 2018-Present | $20m w/ 5 consecutive growth years |

| Investments (Office REIT) – 2022 | $6m |

| Total Investments (Syndication Offerings) – 2022-23 | $7.8m |

| ROAS (Return on Ad Spend) – 2022 | 12.83 |

| Auto-Investment Enrollment | +22% |

| Initial Investments | +58% ($4.5k in 2020 to $7.2k in 2021) |

| Redemption Requests – Post-Covid | ~12% of total shareholders in 2020-23 |

Created an affiliate / partnership program with 200+ partnerships including BusinessInsider, Forbes, and MotleyFool. This review linked is for The MotleyFool’s review. This affiliate program generated over $4.5m in investments for the REIT since 2018.

| Affiliate Program Investments – 2018-Present | $4.5m among 349 new investors |

| Media Partnerships Total | 200+ |

| Premier Media Partnerships | BusinessInsider, Forbes, and MotleyFool |

Enhanced traffic acquisition through SEM/SEO strategies, including content marketing, on-site/off-site link building, and paid search campaigns, which improved lead generation and conversion rates. Redesigned websites to appeal to both institutional and retail investors.

| Conversion Rate | +32% |

| Organic Traffic | +58% |

| Direct Traffic | +40% |

| Branded Search Traffic | +105% |

| Earned Media | +45% |

Led the rebranding of “stREITwise” to “Streitwise,” and product shift from sole REIT into multi-offering syndication marketplace.

| Registered Users | 12,000+ registered users actively engaged with the brand |

| MQL’s (Marketing Qualified Leads) | +155% |

Example of financial influencers. This is an example live reel interview set up with the Streitwise CEO, from @financialprofessional, an account with over 700k followers.

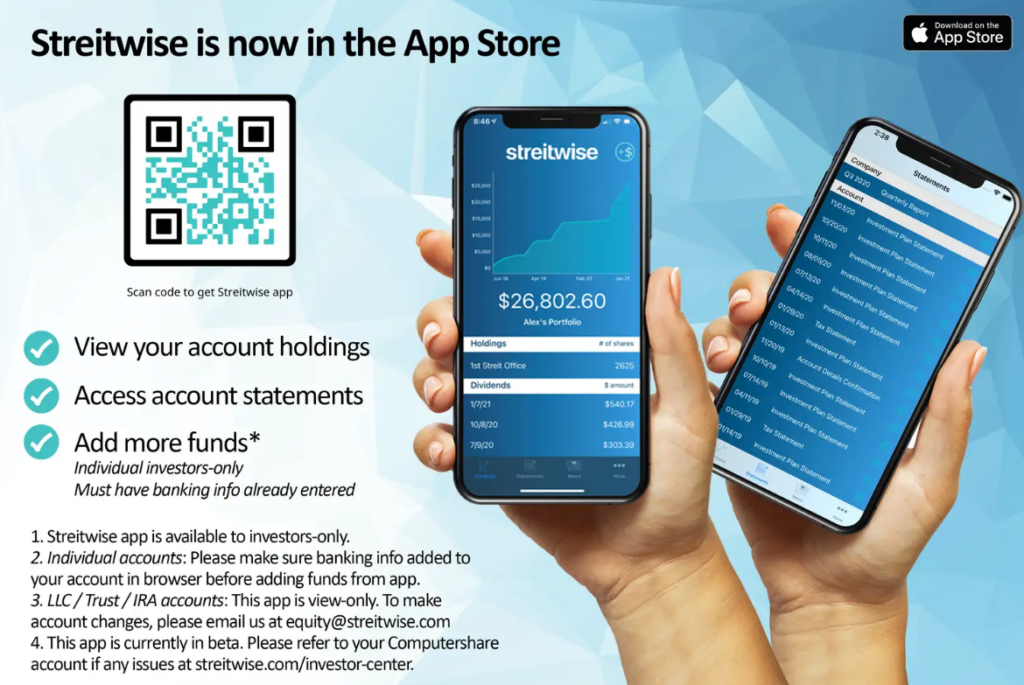

Oversaw the integration of a modern investor portal with a new iOS app for Streitwise investors.

Strategic fundraising outreach to areas where our office real estate assets are to acquire new investors using both geotargeting and demographic targeting with a dedicated lead funnel.

In order to qualify as a Reg A+ REIT, the SEC requires at least 50% of shareholders to vote before each annual meeting. I spearheaded both the annual meeting webinar content, presentation script in collaboration with the board, and the shareholder voter outreach strategy. Since 2018, we have successfully met shareholder quorum each year.

- Testimonial from Co-Founder / CEO

Alex has led our marketing and fundraising initiatives, raising over $20 million from over 1,500 retail investors with the lead funnels to sales pipeline that he created. Alex spearheaded the creation of several separate syndication offerings, helping raise $7.8 million in 2022-23 among accredited retail investors, as an added revenue stream.

His work includes strategic collaboration with the executive team and Board on key decisions such as setting minimum investment thresholds and ensuring SEC compliance in the marketing campaigns.

Alex’s SEM strategies, content marketing, and paid campaigns resulted in a substantial increase in organic traffic, while his website redesigns and lead funnels formed the backbone of our marketing operations.

Jeffrey Karsh

Co-Founder & CEO, Streitwise

Largest Wins at Streitwise

01

Set Up Lead Funnels & Automation Campaigns

Setting these up lead to over 12,000 registeredm a +155% increase in MQL’s, +32% in conversion rates, and eventually over $28 million raised among all offerings

02

New Campaigns

Combined with SEM, Paid Media, and Affiliate Marketing efforts, new revenues increased by over 300% with a total return on ad spend (ROAS) of 12.83 in 2022.

03

Brand Growth

Streitwise became a premiere real estate crowdfunding brand with a fully functioning investor center, iOS app, investor relations team, dividend reinvestment enrollment, and a syndication marketplace to accompany the office REIT.

Looking to grow your fintech / financial services, proptech, or real estate firm? I can help.